How to Fund Reuse Systems? Public Funding Options

While the case for reuse has been made, funding for reuse infrastructure remains the biggest gap to transitioning the U.S. to a reuse economy. Reuse infrastructure refers to wash facilities (i.e., the buildings) and the equipment (vehicles, dishwashing machines, etc.) that make the collection, wash, and redistribution of reusable packaging possible. Other primary costs in creating reuse infrastructure and logistics are upfits to buildings to make them permit-compliant with state food code, as well as the training and wages for staff. Without the funds for the upfront capital expenditure, reuse cannot compete with the outdated but heavily subsidized trash and recycling industries.

So, what’s a reuse service provider to do? Upstream and our partners are working on several levers to help grow and support the reuse industry, and one of them is advocating for and educating around both public and private funding options. The following examples are fully or partially publicly funded. Stay tuned for an upcoming installment where we will explore private funding options. Not all of the following options have funded reuse yet, but all of them are viable possibilities that we are working to make a reality.

Option One: Grants

Grant funding is among the most common and likely most familiar type of funding, providing direct payments without the expectation of repayment. Publicly-funded (e.g. government) grants typically involve a competitive application process. These grants can come from all levels of government, and federal and state grants can be particularly helpful due to their broader scope and generally larger funding pool. Funding for government grants may come from tax programs, landfill tipping fees, fees on public utilities, and budget allocations.

Upstream offers a frequently updated, crowd-sourced funding tracker which is primarily populated with grant funding options. We have also developed Best Practices for Government Reuse Grant Programs, outlining recommendations to government agencies interested in launching reuse-focused grant programs, and with the goal of encouraging and growing more such programs.

Examples of Reuse Grants

Reusable foodware for large institutions (San Francisco)

Reuse Business Development Grant (Massachusetts)

Waste Reduction and Recycling Initiative (Northwestern Territories)

AZ DEQ Recycling Grant Program (Arizona)

Waste Reduction Innovation Grant (Missouri)

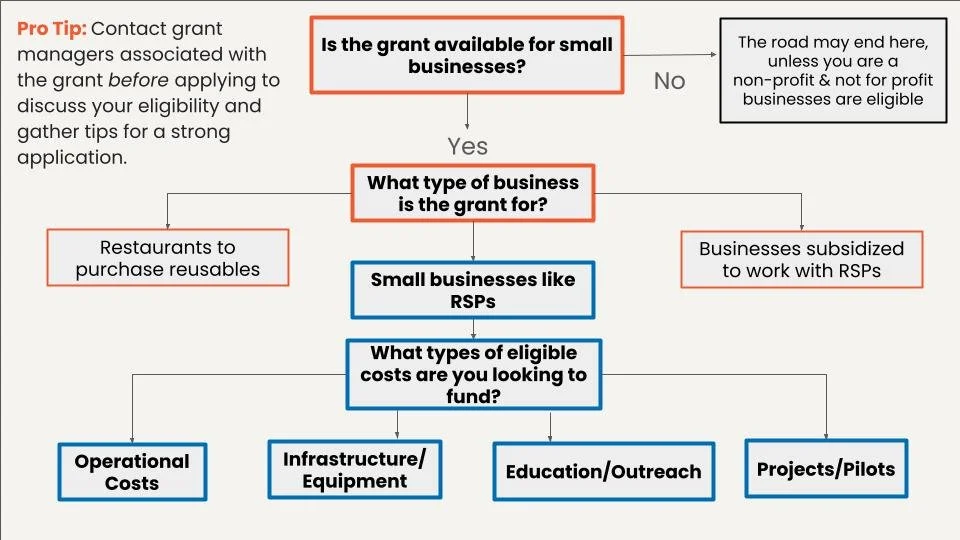

Finding a grant suited for reuse service providers.

Option 2: Low Interest Public Loans

Unlike grants, public loans must be repaid, but at a discounted interest rate relative to privately-backed loans. Currently, low-interest public loans are most common for sustainable infrastructure like clean energy projects and clean drinking water systems.

The money for these kinds of loans typically comes from one of the following sources:

Green banks are mission-driven institutions that use innovative financing to accelerate green initiatives (especially clean energy deployment). There are several green banks around the US and Canada, one example being the New Mexico Climate Investment Center, which issues low-interest loans to local projects aimed at reducing greenhouse gas emissions.

Revolving loan funds (RLFs) use a source of capital, typically offered by a local or state government, to make direct loans to borrowers. Proceeds from loan repayments flow back into the fund and become available to lend again. Government agencies may manage RLFs, or a third-party financial institution may manage the fund and make loans on behalf of the government. The loans are typically long-term and low-interest. RLFs are effective financing initiatives that require high up-front capital but don’t warrant mortgages or equity lines.

State revolving loan funds (SRFs) are loan programs that are capitalized by federal grants, state appropriations and dedicated revenues. States use the funds to provide a range of financial assistance to local governments, including loans, grants and credit enhancement—which could then flow to local projects that benefit the municipality.

Linked-deposit programs allow states to deposit money in banks at below-market interest rates. Banks then leverage those funds to provide short-term, low-interest loans to particular borrowers, often small businesses. These are very popular programs in a number of states.

We are unaware of low interest public loans being utilized to date in the reuse space, but it is a funding model we would like to see used to help reuse service providers establish and scale infrastructure.

Examples outside of reuse infrastructure:

Energy Conservation Assistance Act offers zero-interest rate loans to public schools and 1% rate loans to public entities and California Native American Tribes to finance energy efficiency and energy generation projects, energy storage systems, and electric vehicle charging infrastructure.

Texas Enterprise Fund will provide grants and loans to finance the construction, maintenance, modernization, and operation of electric facilities in Texas.

Option 3: Tax Incentives

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments. The levers for doing so often come in the form of deductions, which help reduce taxable income, and credits, which reduce a tax bill dollar-for-dollar.

While we would like to see tax incentives for reuse facilities, and there is already some ground work being laid to introduce language to do so in California, currently recycling tax incentives are the most proximate examples of waste-reduction tax incentives.

Examples outside of reuse infrastructure:

Property tax exemption: In Texas, any equipment used for pollution control can receive a use determination that can be turned in to the appraisal district to get a property tax exemption.

Income tax credit: Oklahoma offers a recycling facility income tax credit of up to 15% for machinery and equipment, construction and renovation, and expansion.

Option 4: Development Incentives

Development incentives are typically provided within the framework of existing land use or development regulations. They are often used to remove or decrease fees, requirements, or steps in the permit process. This is an incentive that could easily be expanded to encompass reuse infrastructure development.

Examples outside of reuse infrastructure:

Expedited permitting: Chicago’s Green Permit Program reviews permits much faster for projects that meet certain LEED criteria.

Leniency in requirements: Portland’s Floor Area Ratio (FAR) Bonus increases a building’s allowable area in exchange for adding an ecoroof/greenroof.

Option 5: Rebates & Reimbursements

A rebate is a sum of money that is credited or returned after completion of a transaction. They are commonly offered by electricity service providers for upgrades to high efficiency appliances, including dishwashers.

In some EPR programs, municipal expenses for reuse of covered materials are reimbursable from producer funds.

Examples of rebates for reuse:

MNimize Rebates (Minnesota): Offers up to a certain amount toward eligible expenses to reduce single-use plastic, including reusable dishware.

PACE Rebates (Boulder, CO): A one-time incentive toward purchasing reusable solutions, which can cover up to 70% of total project costs.

Option 6: Award Competitions

Designed to spur innovation, award competitions can include cash prizes, recognition, and / or inclusion in an incubator program that coaches entrepreneurs and innovators. These are frequently run by private entities and NGOs—Upstream’s own Reusies, for example, or Trellis’ Emerging Leaders Program. Government award programs, however, are also picking up momentum.

Examples of public award competitions for reuse:

Circular Accelerator & Circular Showcase (Austin, TX): Specifically for innovators and small businesses that are working to reduce waste.

FuzeHub (New York State): Though not specific to sustainability or reuse, FuzeHub offers awards to companies that effectively prove the commercialization potential of their technology or product.

Department of Energy American Made Program: Awards energy innovations through various prize programs. In 2024, they ran the ReX Before Recycling competition and awarded several reuse solutions.

Option 7: Green Bonds

Green bonds are similar to conventional bonds in that they are a type of fixed-income investment—the distinction being that they are specifically designed to fund projects with a positive environmental impact. They allow investors to earn a return while financing sustainable initiatives, such as renewable energy, energy efficiency, and climate change mitigation. The proceeds from green bonds are used to finance or refinance projects that contribute to environmental sustainability.

Green bonds are a financial instrument used particularly by local governments. When a local government issues a green bond, investors purchase these bonds, effectively lending money to the municipality. The funds must be used exclusively for predefined green projects. Green bonds are a fairly new concept in the last 20 years or so but coming to be increasingly common.

Applied to the reuse sector, green bonds would be ideal for funding the buildout of public reuse infrastructure. A potential application could be a municipal green bond used to build a community wash hub, which could be made available for reuse service providers to utilize. Upstream is currently working on creating model municipal financing instruments for cities following this concept. In states with active EPR for packaging laws, municipal funding for reuse infrastructure would be an ideal use of producer fees.

Examples:

Infrastructure funding: Though not for reuse, green bonds were used to fund drinking water infrastructure used in Asheville, NC.

Circular economy funding: There are several international examples of green bonds used to fund the circular economy, including reuse projects.