Beverage Refill & The New Reuse Economy

how the beverage sector’s re-embrace of refill will transform the industry

The beverage sector is one of the ripest sectors for reuse. Leaving out closed systems like reuse for on-site dining, more beverage reuse/refill systems operate at scale than all other open systems (like reuse for take-out and delivery, or reuse for other consumer packaged goods). Virtually all of them use Deposit-Return Systems (DRS) to ensure they get their bottles back.

The original mass-market Deposit-Return Systems were created by beer, soda and dairy companies to get their bottles back for washing and refilling. The infrastructure they built of local distribution and washing hubs allowed virtually all commercial beverages sold in the United States to be sold in refillable bottles.

The birth of the Throw-Away Economy and the advent of legislative DRS in the US

But things changed after World War II. Extraction companies (like mining, paper, and petrochemical corporations) which had fueled the war effort - furthered their partnerships with consumer goods, fast food and beverage companies.

Big soda and beer brands shifted their packaging away from refillable glass to disposable aluminum and glass, as well as plastic containers for soft drinks and other non-alcoholic beverages.

Then, they eliminated the deposit on these containers. Not surprisingly, a significant amount of beverage containers ended up in the environment as litter, which prompted the development of what we now call “bottle bills,” which are mandatory Deposit-Return Systems requiring beverage companies to take their bottles back for reuse or recycling, and to ensure that they won’t be littered.

Environmental advocates eventually succeeded in passing bottle bills in 10 states. But unfortunately, DRS has not proliferated beyond these states in the US, nor have these systems brought refillable bottles back… yet.

Other countries reject disposability and embrace refill

However, in other countries, beer, wine, soda, dairy and bottled water companies have continued to operate and - in some cases - expand their refillable beverage container lines.

In Germany, 82% of beer is sold in refillable bottles. and 99% of those bottles are returned for refilling.

Overall, 54% of beverages sold in Germany are in refillables.

In Ontario, Canada, 84% of beer is sold in refillable bottles.

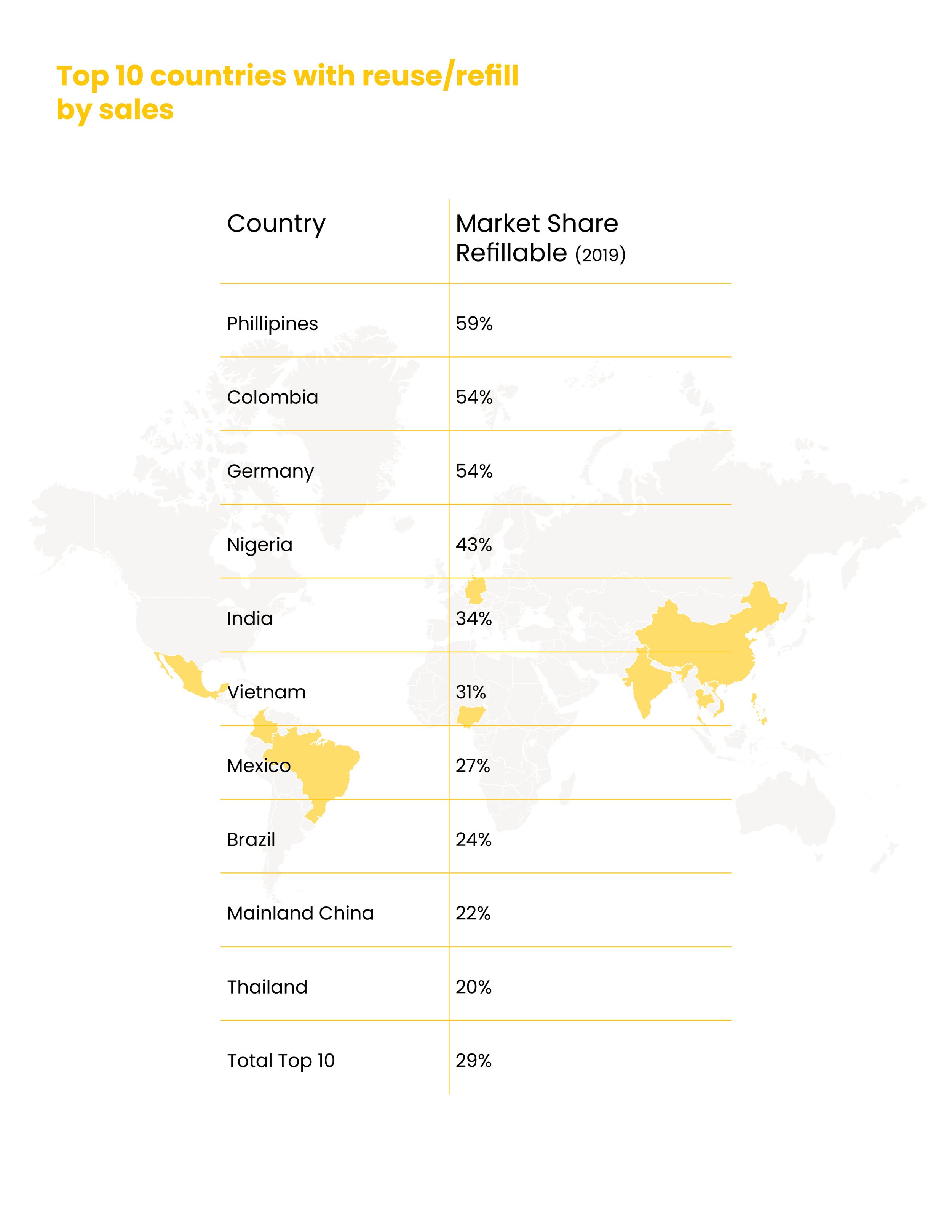

In Latin American countries, refillables account for 27% of sales in Mexico, 54% in Columbia, and 24% in Brazil.

In Asia, Mainland China has 22% of beverages sold in refillables, Vietnam is 31%, Thailand is 20% and India refillables are at 34%.

On the African continent, in Nigeria 43% of beverages are sold in refillables.

The Philippines have the highest national rate – where 59% of beverages are sold in refillable bottles.

Data credit: Reloop, “What We Waste.”

Brands still use refillables around the world

Many individual beverage companies, as well – especially mineral water and beer companies – never shifted away from refillable to one-way containers.

The Beer Store, co-owned by Labatt Brewing Company, Molson Coors Canada and Sleeman Breweries, began its refillable beer cooperative and deposit return system in 1927. Since its inception, the company has recovered 75 billion beer bottles from refilling.

In 40 markets, 25% or more of Coca-Cola’s products are sold in refillable bottles. Globally, refillables already account for 16% of Coca-Cola’s total bottle usage in 2020, and the company recently pledged to sell 25% of their product in refillable packaging by 2030.

In Oregon, ten of the largest breweries banded together to create a refillable packaging system with the Oregon Beverage Recycling Cooperative (OBRC), which is the primary service organization for Oregon’s bottle deposit-return system. The Cooperative owns the refillable bottles and leases them to the brewers at a price less than single-use glass and aluminum cans.

Materials

Refillable bottles are typically either made from glass or PET plastic (#1). Aluminum packaging manufacturers are also beginning to make refillable bottles, although this is a very small share of the market currently. Glass bottles can be reused up to 50 times and PET bottles can be reused up to 25 times before they are retired and recycled.

Environmental benefits

Let’s talk about environmental benefits: according to a comprehensive life-cycle analysis of beverage packaging, the break-even point for reusable glass bottles and single-use glass bottles was reached after 2 cycles (200km from plant to distributor).

After the third use, reusable glass bottles are already less impactful than single-use glass, PET or aluminum cans.

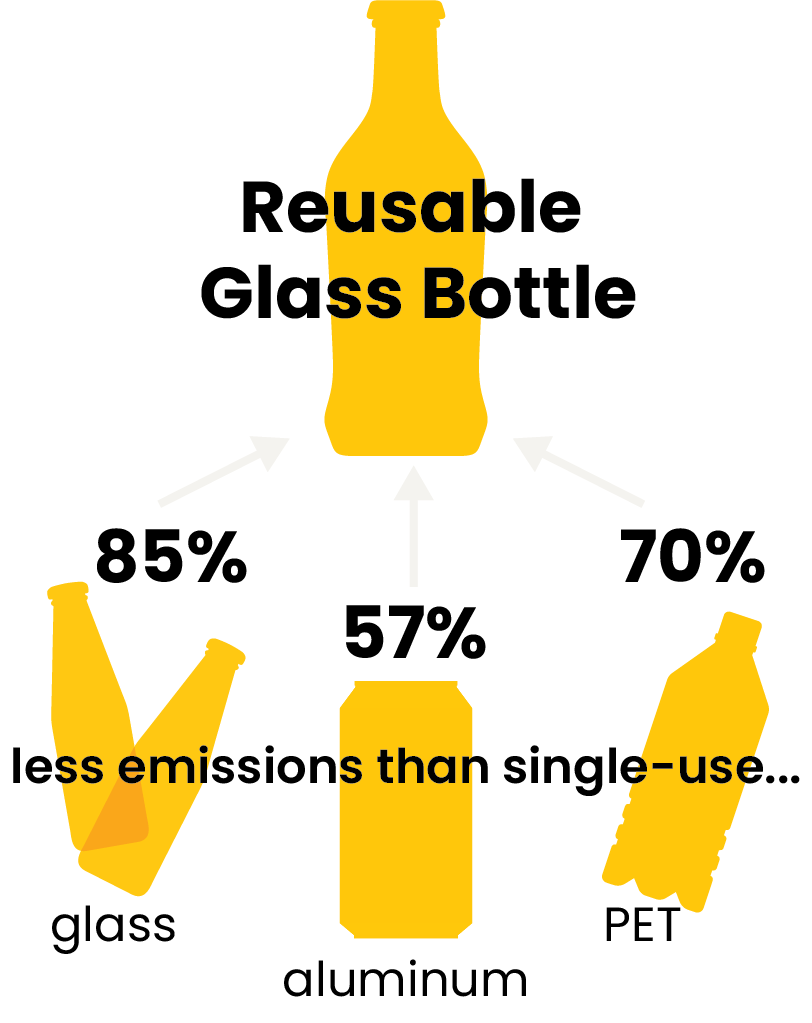

In terms of climate emissions, refillable glass bottles used 25 times and then recycled,create:

85% less climate emissions than single-use glass.

57% less than aluminum cans.

70% less than single-use PET.

And 93% less energy is consumed by a refillable bottle that can be reused 25 times, as opposed to single-use bottles

In comparing refillable PET to single-use PET, refillable PET bottles can:

Save up to 40% of the raw materials and,

50% of the greenhouse gas emissions from the production of single-use plastic bottles.

Lastly, when more beverages are sold in refillable bottles, the benefit to the ocean is amplified. Oceana estimates that just a 10% increase in the share of beverages sold in refillable bottles could result in a 22% decrease in marine plastic pollution. This would keep 4.5 to 7.6 billion plastic bottles out of the ocean each year.

How refill systems work (and can work) for beverage containers

Beverage companies either own their refillable bottles (like Coca-Cola) or they lease them from a service provider (like the Oregon Brewers example). Once the consumer has finished their beverage, they can take advantage of different options to return the refillable bottle back to the brand.

Return on the go. In most states that have mandatory deposit-return systems (bottle bills), the “return-to-store” method is the most popular. Consumers take their beverage containers to either a retailer or a redemption center, where they can use reverse-vending machines, or have their bottles hand-counted for a refund, or use bag-drop technology.

For retailers that don’t want empty bottles in their stores, but want to support sustainable packaging while increasing foot traffic, bag-drop systems can be very effective. With bag-drop, consumers put all their returnables into a bag with a sticker that has a bar or QR code tied to the consumer’s account. They then “drop” the bag into a kiosk in the parking lot which is picked up by the service provider. Consumers generally get their refunds through an electronic kiosk at the store where there’s an incentive for them to use it on new purchases.

Return from home. It’s also possible (although not as widely used) to have reusable packaging picked up from home by a service (e.g. a logistics company or through a curbside collection provider). For this model, modifying existing infrastructure will be important – either through incorporating reusable packaging into curbside collection for recycling, or by adding “milk-man-type” bins outside homes and apartments where logistics companies can pick up reusable packaging as they drop off new products.

Once the bottles are collected from the consumer and sorted at recycling facilities, they are returned to the bottling plant, where they are put on a washing line. After the bottles are washed, sanitized and dried, the clean bottles are refilled on production lines whose speeds match those of one-way bottles.

Conclusion

Every time a consumable product is sold in a reusable package, the extraction and waste cycles stop. Forests remain forests. Plastic pollution ceases. Landfills and recycling supply chains are not needed. And with the increased attention on Scope 3 Climate Emissions from brands (the emissions from a value chain not directly owned or controlled by the company) – plus the potential for cost savings once the infrastructure is built – refillable packaging is making a comeback.

Just four companies account for over 40% of sales (in terms of revenue) for the enormous non-alcoholic ready-to-drink market. These companies have the ability to change the overall beverage market, which means that increasing refillables is achievable in the near-term.